We hope everyone has been staying safe and warm or enjoying their snowy adventures through the blizzard! As the road season draws closer, the Board wants to keep everyone updated and informed.

The first piece of hosting any sanctioned race is permitting and insurance. Most race participants have never considered the General Liability Certificate of Insurance for USAC races, but since NABRA sanctioning is unfamiliar, we will go into detail here about the coverage and what that means for racers.

General Liability

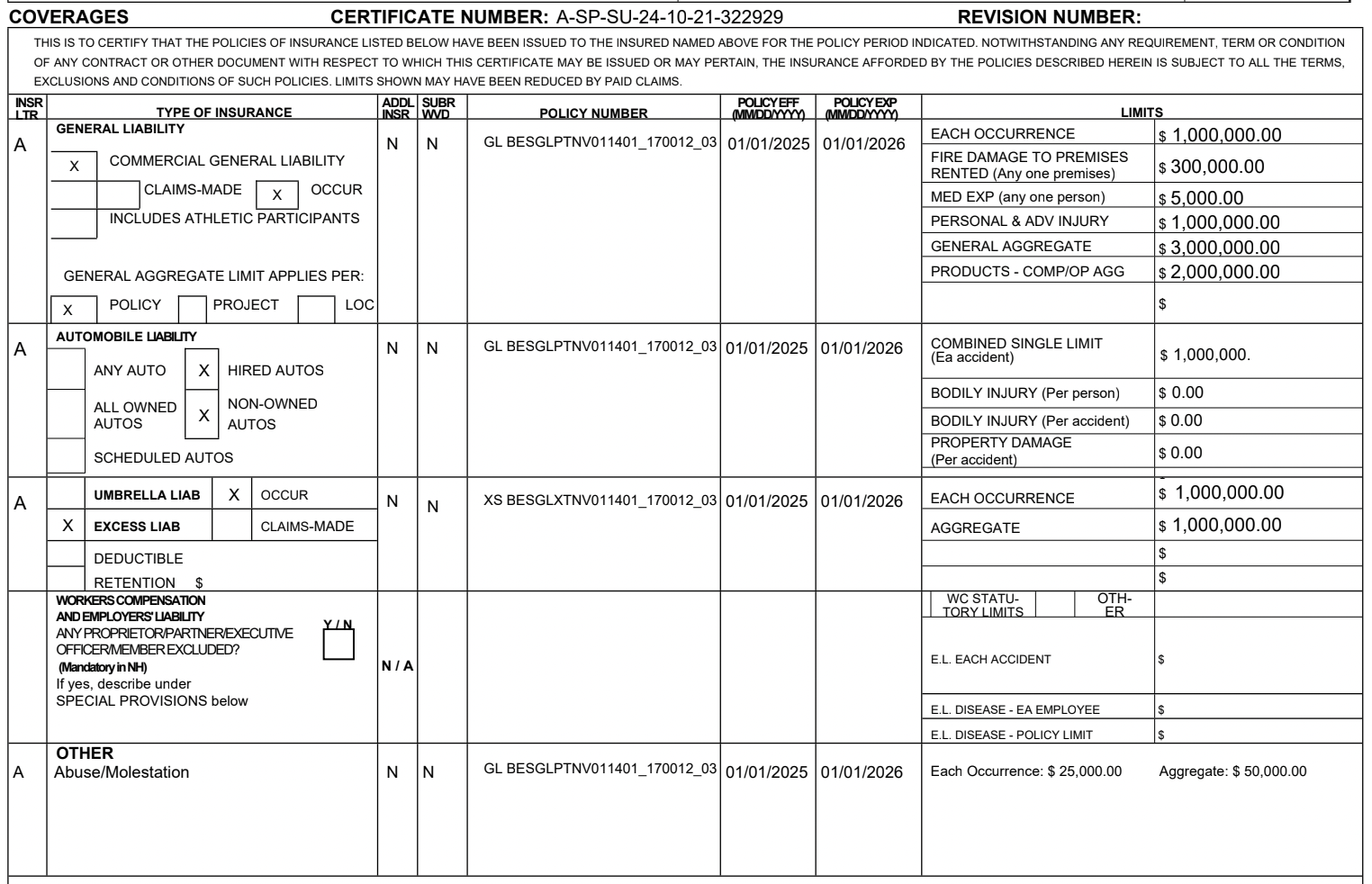

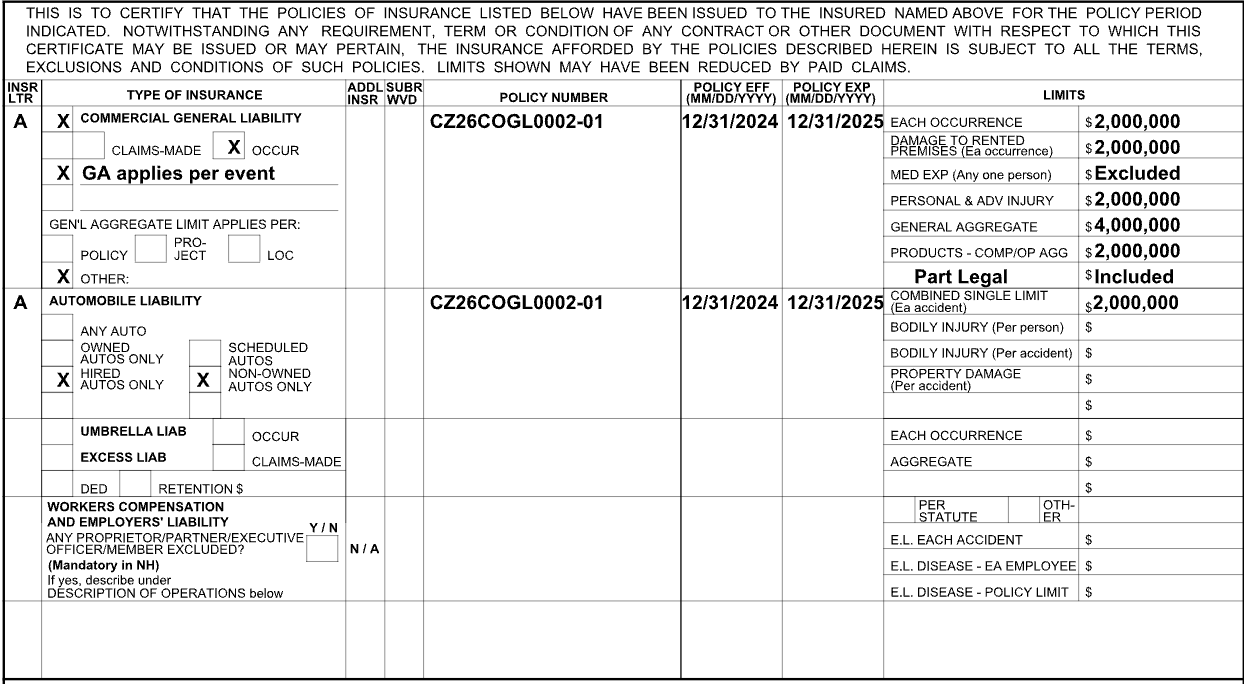

NABRA insurance covers all the required insurance amounts from NYC Parks and effectively matches the coverage amounts of USAC’s general liability policy. Please see below examples of the Certificates of Insurance from each to illustrate this point.

NABRA General Liability - Example COI

USAC General Liability - Example COI

The main difference in coverage is that NABRA’s insurance has umbrella liability to obtain the same effective coverage amounts as insurance through USAC. The process for insurance claims is the same, and both policies include obtaining legal representation in case of a lawsuit for a covered event. CRCA will also have Club insurance that will cover coaching sessions and official group rides.

Medical Insurance Coverage for Racers

In conjunction with its general liability coverage, NABRA holds an excess medical coverage policy for all participants. This policy acts as primary insurance for those without primary insurance. The policy has $50,000 maximum coverage with a $2,500 deductible. (Coverage was increased from a $25,000 max / $1,000 deductible in 2025.) Full details on this medical policy here.

USAC-sanctioned races also carry an excess medical coverage policy for all participants at a $50,000 limit with a $5,000 deductible (More info here under “EVENT-SPECIFIC RACING INSURANCE”).

In addition, USA Cycling offers optional individual excess medical coverage called “USAC 365” for an annual fee of $365. This covers USAC members who have opted into the insurance during group rides and USAC-sanctioned events for $50,000 maximum coverage and a $0 deductible. (More info here on USAC 365). CRCA members who hold USAC licenses can continue to opt into this service, but it will not cover them in CRCA’s NABRA-sanctioned races.

NABRA is unable to offer a similar optional service due to their insurance broker’s requirements. To offer comparable SPOT insurance, they would have to require all 4,000-5,000 OBRA members to purchase the service, which would significantly increase the cost of membership.

Note from the Board: We recognize that a $2,500 deductible might still be cost-prohibitive for some. If a race participant without primary insurance needs to rely on this excess medical insurance while following the rules of racing in Central Park, Board members can assist in crowdfunding for the deductible amount.

Questions

If you have questions, please email president@crca.net. If there are a lot of questions, we will update membership in a follow-up post rather than responding individually.

We will continue to keep membership informed as this season approaches. We hope everyone shares our goal of safe, competitive park racing, and this information is simply for peace of mind. Happy training!